In 2024, technology has taken stock picking to new heights. Whether you’re a beginner investor or an experienced trader, getting accurate stock picks doesn’t have to involve expensive tools or complex software. Free stock screeners have evolved significantly, offering powerful filtering options that help you find winning stocks with almost surgical precision.

In this article, we’ll walk you through the best free stock screeners for 2024 that can boost your stock-picking accuracy and help you spot the next big opportunity in the market.

What Is a Stock Screener?

A stock screener is an essential tool that allows investors to filter stocks based on various criteria, such as price, market capitalization, P/E ratio, dividend yield, sector, and many other fundamental and technical factors. A good stock screener helps you find stocks that align with your investment strategy—whether it’s short-term momentum trading, swing trading, or long-term investing.

How Stock Screeners Can Help You Achieve 99% Accurate Stock Picks

While no stock screening tool is perfect, combining different strategies and criteria can significantly increase your odds of success. By using multiple filters such as technical indicators, earnings growth, and financial health, investors can identify stocks that meet their stringent requirements.

The key is customization and understanding which metrics truly matter for your strategy. Here are some critical filters to keep in mind when aiming for top-tier stock picks:

- Price-to-Earnings Ratio (P/E)

- Earnings Growth

- Technical Indicators (RSI, Moving Averages)

- Dividend Yield

- Volume and Liquidity

Top 5 Free Stock Screeners for 2024

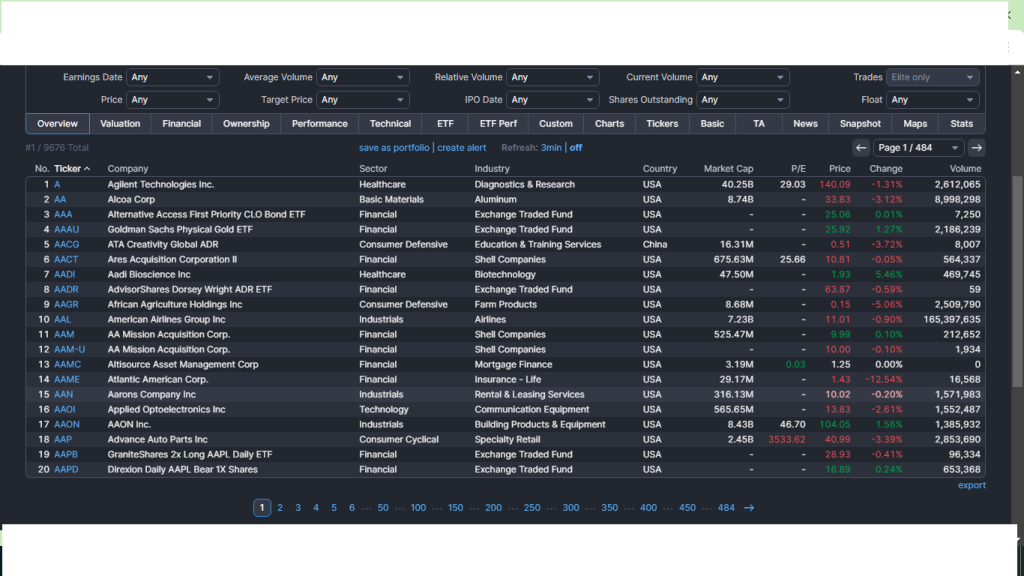

1. Finviz (Financial Visualizations)

Perfect for: Comprehensive Fundamental and Technical Screening

Finviz continues to be one of the most popular and powerful free stock screeners in 2024. It offers a range of filters for both technical and fundamental analysis, including P/E ratios, moving averages, and candlestick patterns. With its easy-to-use interface, Finviz remains a go-to tool for retail traders and long-term investors alike.

What’s New in 2024:

- Use Finviz to set up custom filters combining both technical indicators (like RSI < 30) and fundamental ratios (like P/E < 15) for balanced stock picks.

- AI-driven stock pattern recognition to identify emerging trends.

- Enhanced heatmaps for sector-wide analysis.

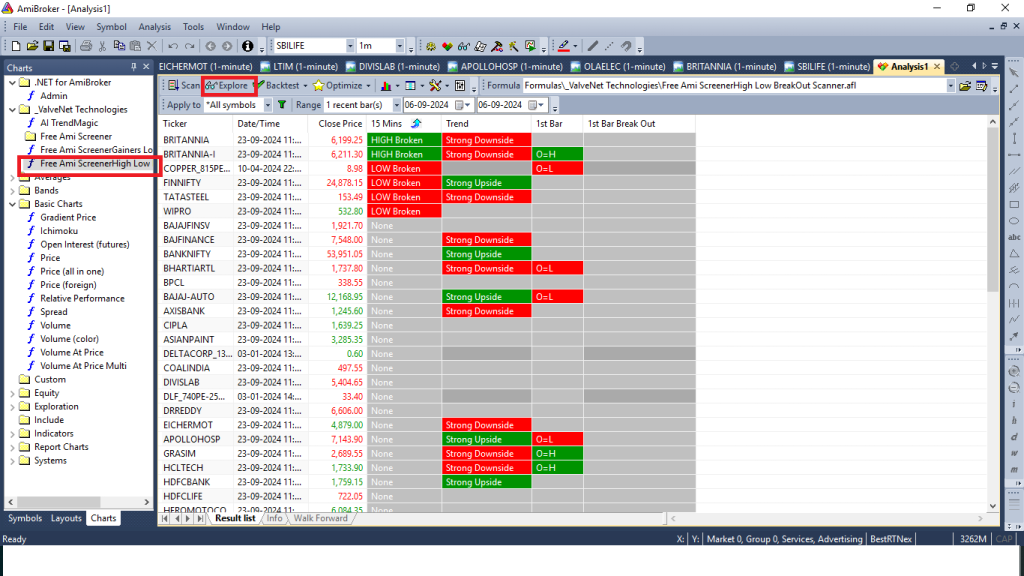

2.ValveNet Technologies

Perfect for Intraday traders

As the stock market evolves, traders and investors are looking for smarter, faster, and more reliable ways to pick winning stocks. In 2024, ValveNet Technologies stepped up to meet this demand by offering its Free AmiScanner, a powerful tool designed for beginners and seasoned traders. AmiScreener is an innovative stock screener that integrates seamlessly with Amibroker, offering precision and advanced functionality that helps you find the best stocks based on custom criteria.

Unlike generic stock screeners, AmiScanner integrates directly with the popular Amibroker platform, allowing users to create and apply custom screening algorithms based on technical and fundamental data. Whether you’re looking for growth stocks, undervalued gems, or short-term trading opportunities, AmiScanner provides a flexible and robust solution.

The best part? It’s completely free for 2024—giving traders access to powerful features without the hefty price tag associated with other premium screeners.

What’s New in 2024:

- It shows the Trend Strength of the particular stocks

- Make a profit from the market in both directions

- Learn to trade without risking your capital

- Find the Best stocks for day trading

- Automatic scanning

- Scan for stocks that are going to move big

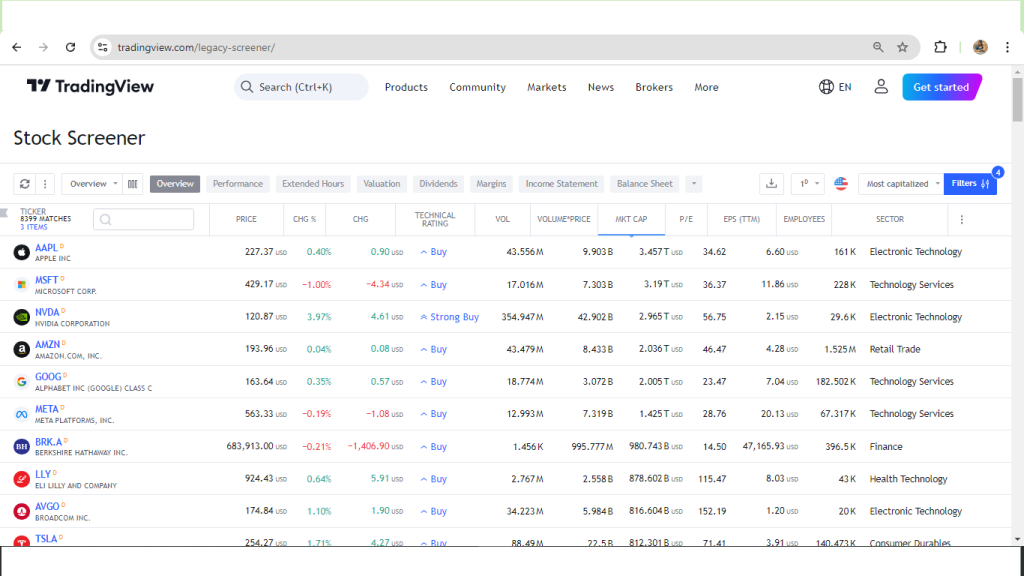

3. TradingView

Perfect for: Charting and Custom Alerts

TradingView offers one of the most advanced free charting tools in 2024, making it a favorite for technical traders. You can create custom stock screens using hundreds of technical indicators and set up real-time alerts based on your criteria. Whether you’re looking for moving average crossovers, price breakouts, or overbought conditions, TradingView has you covered.

What’s New in 2024:

- Integration with social media platforms for community-driven trade ideas.

- Custom AI alerts for key technical triggers based on past trading behavior.

- Combine the MACD (Moving Average Convergence Divergence) with volume analysis to filter stocks that are showing bullish momentum in the early stages of a breakout.

4. Zacks Stock Screener

Perfect for: Earnings-Based Stock Picks

Zacks Investment Research is known for its focus on earnings and its proprietary Zacks Rank system, which ranks stocks based on earnings revisions and surprise earnings. The Zacks stock screener is ideal for investors who want to focus on companies with strong earnings growth potential

What’s New in 2024:

- AI-powered earnings forecast for more accurate stock predictions.

- New filters to screen for stocks with the highest potential for earnings surprises.

- Focus on stocks with a Zacks Rank of 1 (Strong Buy) and positive earnings revisions over the last three months to pinpoint companies that could experience significant price appreciation.

5. Stock Rover

Perfect for: Deep Fundamental Analysis

Stock Rover is one of the best free tools for investors who prefer a deep dive into company fundamentals. In 2024, Stock Rover continues to offer detailed financial metrics, including P/E ratios, cash flow, and return on equity, making it ideal for long-term value investors.

What’s New in 2024:

- They expanded sector-specific screeners to identify the best-performing companies within specific industries.

- Custom valuation models that predict stock fair value.

- Use Stock Rover’s powerful dividend filters to find high-quality dividend-paying stocks with solid financials, focusing on those with a history of increasing payouts.

6. MarketSmith

Perfect for: Growth Stock Screening

MarketSmith, a product from Investor’s Business Daily, is widely recognized for its growth stock screening capabilities. Although it’s a premium tool, the free version offers many powerful features for stock screening. It’s particularly useful for identifying stocks with high earnings and revenue growth, which is ideal for momentum and growth investors.

What’s New in 2024:

- New growth screens focused on disruptive sectors like AI, renewable energy, and biotechnology.

- Enhanced stock charts with automatic trendline drawing for quicker analysis.

- Screen for stocks with earnings growth of at least 20% year-over-year, combined with an increase in institutional buying to find growth stocks ready to take off.