In the world of trading platforms, Amibroker has earned a reputation for its flexibility, powerful tools, and robust performance. But what makes it stand out, and is it the best trading platform for you? In this article, we’ll break down Amibroker’s features, advantages, limitations, and how it stacks up against other platforms—all from a user experience perspective.

What is an amibroker?

Amibroker is a versatile trading and technical analysis software widely recognised for its deep customisation options, robust charting tools, and advanced features for backtesting and developing trading strategies. This platform is especially popular among users who rely on sophisticated analytical tools, including algo traders, technical analysts, and active day traders seeking precision and adaptability in their trading workflows.

Amibroker is ideal for anyone involved in trading and investing who needs a robust, customizable, and efficient tool to enhance their trading decisions. Whether you trade stocks, futures, options, or forex, Amibroker provides the necessary tools for developing, testing, and optimizing trading strategies.

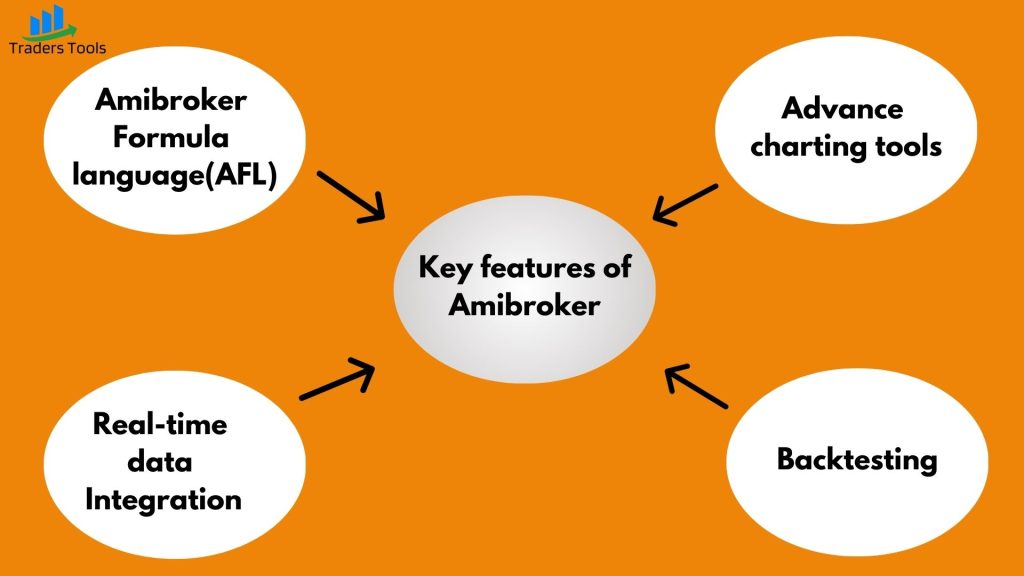

What are the key features of Amibroker?

Here’s a more detailed breakdown of Amibroker’s key features that enhance user experience and make it stand out among trading platforms:

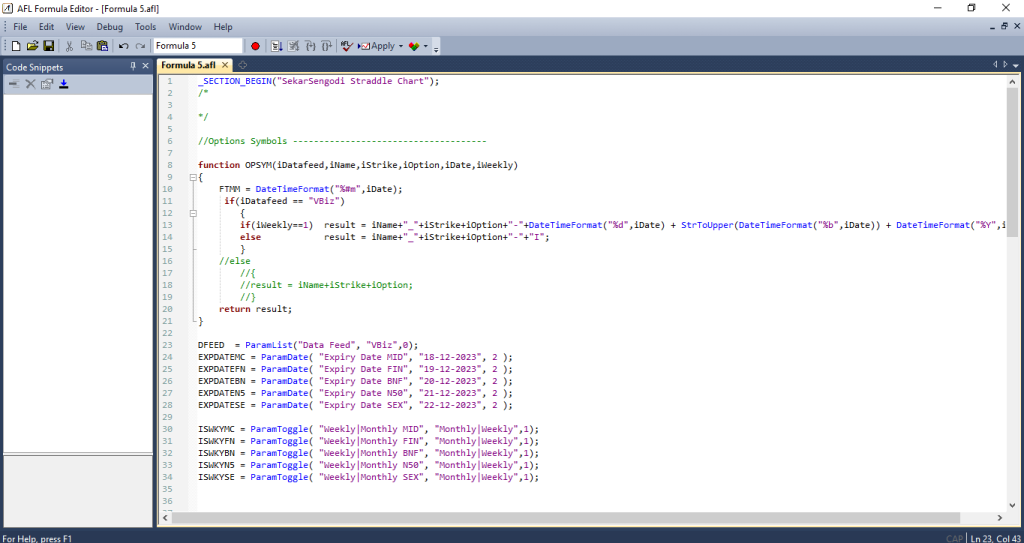

1. Amibroker Formula Language (AFL)

Amibroker Formula Language (AFL) is one of the platform’s most powerful features. AFL allows traders to create, test, and automate complex trading strategies using custom indicators and system logic. Here I shared the snapshot for the AFL Formula editor

- Design unique indicators and trading signals.

- Automate buy and sell conditions based on specific criteria.

- Backtest strategies with historical data to assess performance before applying them live.

For users comfortable with coding or willing to learn, AFL can dramatically expand what they can achieve on Amibroker. This feature is a major reason why advanced traders and algo traders prefer Amibroker.

2. Real-Time Data Integration

Amibroker supports real-time data integration from popular exchanges, such as NSE, BSE, and MCX, through third-party data vendors. With live data feeds, users can monitor the market in real-time, execute trades instantly, and adjust their strategies on the fly. The platform’s compatibility with various brokers and data providers ensures that traders can access timely and accurate market data. Here I choose one of the videos of data vendor integration in real-time data for Amibroker.

This integration is crucial for day traders and intraday analysts who rely on up-to-the-minute information to make split-second decisions.

3. Advanced Charting and Visualisation Tools

Amibroker offers a range of chart types, including candlestick, bar, Renko, and line charts, allowing users to visualize market data in multiple ways. The platform’s customizable indicators and color schemes make it possible to tailor charts according to individual needs.

Key benefits include:

- Over 100 built-in indicators and drawing tools.

- Easy integration of custom indicators via AFL.

- High-resolution charting for clear and precise data visualisation.

Here is the Nifty chart with several technical indicators applied

This advanced charting ability enhances the overall user experience by allowing traders to quickly and accurately assess trends, identify opportunities, and make informed decisions.

4. Backtesting and Optimization

Amibroker’s backtesting engine is another standout feature, offering robust tools to test strategies against historical data. It supports multithreaded backtesting, which means it can handle complex calculations quickly and efficiently. Traders can evaluate the profitability of a strategy and determine potential risks before applying it in live markets.

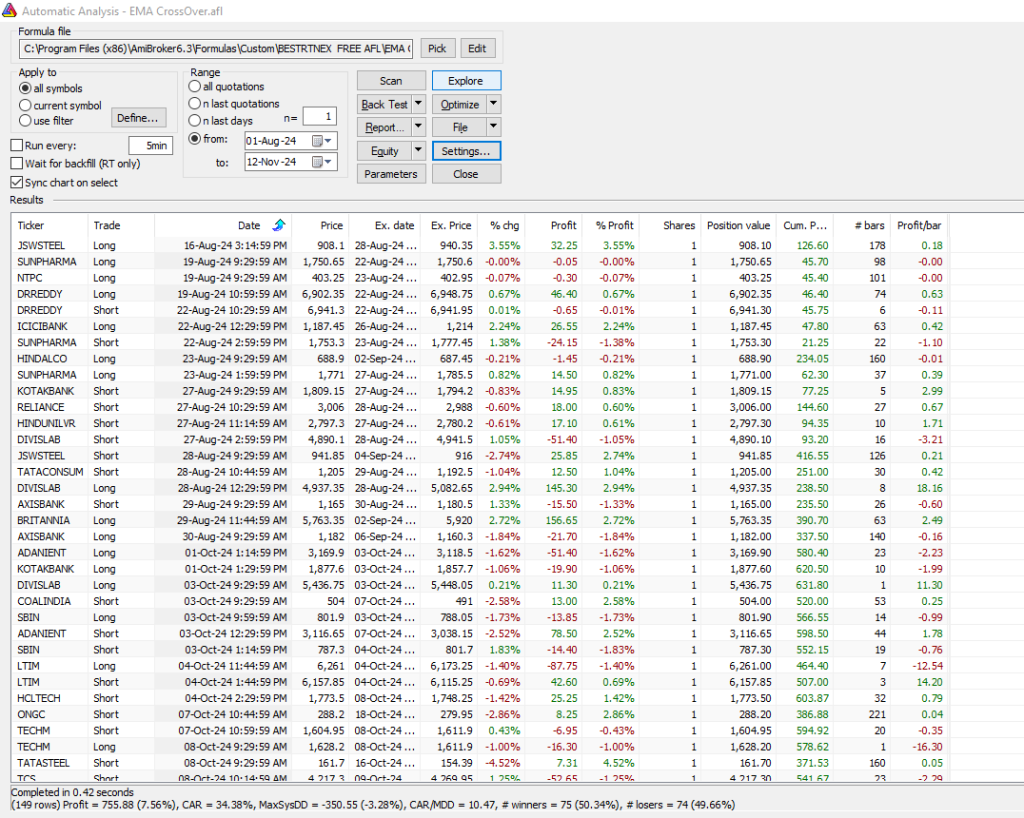

Here I mentioned, “How to implement backtesting in Amibroker.”

Firstly Go to the Analysis option in the top Amibroker menu and Select Old Automatic Analysis. (If prompted to switch to the New Analysis feature, choose to stay with Old Automatic Analysis since it’s simpler for beginners.)

Step:1 Pick the AFl for backtesting. By default, AFl files are saved in the custom folder under the Amibroker Installation directory, just as the path shown in the above image

Step 2: Select the stock in which you want to backtest, as shown in the image. First-timers are advised to backtest on the “current symbol,” which is the same stock chart in your Amibroker

Step 3: Select the data range for the backtest. Recommended to run on “all Quotations” as shown above

Step 4: Click the parameters button to set/change AFL parameters.

Step 5: Click the “setting” button. This opens the AA setting window, which is very important for backtesting

The platform also includes optimisation tools that let users adjust variables within their strategy to find the most profitable combination. For instance, traders can experiment with different stop-loss levels, profit targets, and entry conditions to maximise the strategy’s effectiveness.

5. Extensive Community

Amibroker has a large, active user community that includes experienced traders, developers, and financial analysts. This community offers:

- Extensive libraries of AFL codes, custom indicators, and strategies.

- Discussion forums for troubleshooting, sharing ideas, and learning from others.

- Online tutorials, articles, and educational resources.

This vast support network makes the platform more accessible, especially for beginners who may need assistance in setting up data feeds or coding strategies.

6. Amibroker customer support review

Amibroker provides a responsive online support system where users can submit any questions or concerns related to the platform. Typically, the support team responds within 1-3 business days, addressing user queries promptly. Known for their dedication, the customer support team ensures that any issues raised by customers are thoroughly resolved, offering reliable assistance for a smooth user experience.

7. Compatibility and Flexibility for Algo Trading

Amibroker is compatible with multiple trading platforms, brokers, and APIs, allowing traders to connect and automate trading strategies seamlessly. Algo traders can execute automated buy and sell orders based on their AFL scripts, ensuring their strategies run even when they’re away from their computers.

Amibroker’s automation capabilities are highly valued by traders who use strategies requiring minimal human intervention, such as high-frequency trading or market arbitrage. By integrating with brokers and third-party trading systems, Amibroker can be adapted to most algorithmic trading needs.

8. Custom Alerts and Notifications

Amibroker provides the ability to set up custom alerts and notifications based on specific conditions in your trading strategies. For example, a trader can set alerts for when certain price levels are reached or for when buy/sell signals are triggered by their strategy. Alerts can be set to appear on-screen or sent via email or SMS, ensuring traders are always informed, even when they’re not actively monitoring the platform.

Conclusion:

In summary, Amibroker offers numerous unique features that competing platforms lack, making it a standout choice in the market. By thoroughly exploring Amibroker, investors can discover valuable insights and potentially increase profits. For those seeking faster, more efficient scanning with Amibroker for real-time and historical data, various data providers are on the market. If you’re an experienced Amibroker user, we’d love to hear about your experience in the comments below! Happy investing!”