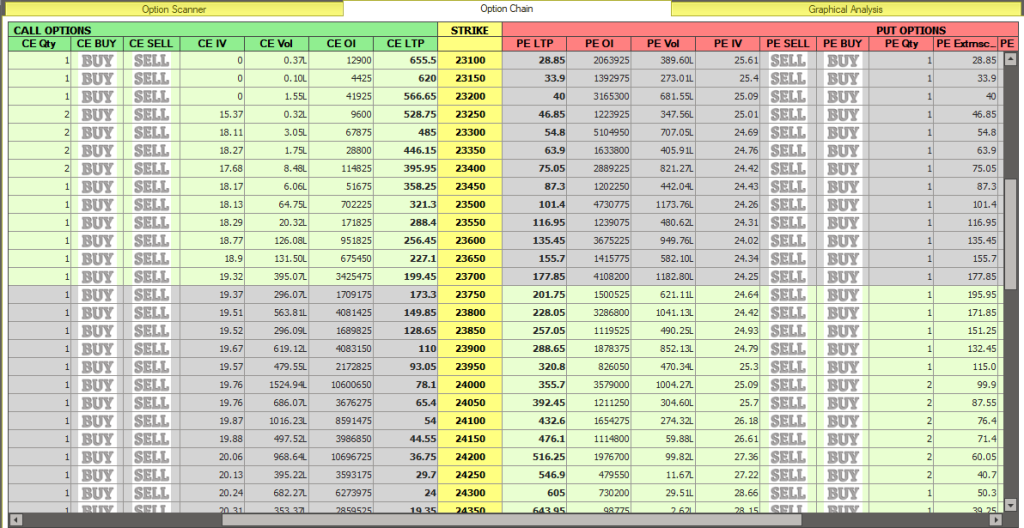

The world of options trading can initially seem intimidating, but understanding the option chain is a great place to start. The option chain is an essential tool for traders, offering valuable insights into market sentiment, price movements, and potential trading opportunities. Let’s break it down in simple terms to help you get started.

Options have a language all of their own, and when you begin to trade options, the information may seem overwhelming. When looking at an option chart, it first seems like rows of random numbers, but option chain charts provide valuable information about the security today and where it might be going in the future.

An option chain has two sections: Calls and puts.

A call option gives the right to buy a stock while a put gives the right to sell a stock.

What is an Option Chain?

An option chain is a listing of all available options contracts for a particular stock, index, or asset. It’s organized in a tabular format, displaying call and put options for different strike prices and expiration dates. When viewed live, the option chain reflects real-time updates in premiums, volumes, and other critical metrics, allowing traders to make informed decisions.

What an Options Chain Tells You

Options contracts allow investors to buy or sell a security at a preset price. Options derive their value from the underlying security or stock, which is why they are considered derivatives.

Key components of a Live Option Chain:

Strike Price

The predetermined price at which an option can be exercised. Strike prices are listed in the center of the option chain.The strike price is the price at which higher strike prices are almost always less expensive than lower striked calls. The reverse is true for put options; lower strike prices also translate into lower option prices. With options, the market prices must cross over the strike price to be executable.

Calls and Puts:

Options are divided into two categories:

Call options: The right to buy the underlying asset at the strike price.

A call option gives you the right (but not the obligation) to purchase 50 shares of the stock at a certain price up to a certain date.

Put options: The right to sell the underlying asset at the strike price

A put option also gives you the right ( and again, not the obligation) to sell 50 shares at a certain price up to a certain date. Call options are always listed first.

Premium:

The price of an option contract. It consists of intrinsic value and time value.The last price is the most recent posted trade, and the change column shows how much the last trade varied from the previous day’s closing price. Bid and ask show the prices that buyers and sellers, respectively, are willing to trade at right now.

Bid and Ask Prices:

The highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask)

Open Interest:

The total number of outstanding contracts that haven’t been settled, High OI Indicates strong interest in a particular strike price.

Open interest is the number of options that exist for a stock and include options that were opened in days prior. A high number of open interest means that investors are interested in that stock for that particular strike price and expiration date.

Volume:

The number of contracts traded during the day. High volume indicates high activity for a specific option. It serves as an essential metric for traders because it highlights liquidity and interest. Options with higher volume are easier to buy or sell at desired prices, reducing slippage. For beginners, observing volume can help identify popular strike prices and expirations, making it easier to gauge market activity.

Implied Volatility (IV):

Represents the market’s expectation of future volatility. Higher IV leads to higher option premiums.

Understanding IV: Implied Volatility reflects how much the market expects the underlying assets price to fluctuate in the future. It is derived from the option premium using mathematical models like Black-Scholes.

Why It Matters: A higher IV means the market expects significant price movements, often due to upcoming events like earnings announcements or macroeconomic news. Conversely, lower IV suggests stable price expectations.

Trading implications: Traders can use IV to identify overvalued or undervalued options. For instance, when IV is high, options premiums are more expensive, and strategies like selling options might be beneficial. When IV is low, buying options may be more cost-effective.

Expiration Date:

The date on which the option contract expires. Options are typically available for weekly,monthly , and sometimes quarterly expirations.

Why Expiration Matters: As the expiration date approaches, the time value of an option decreases, a phenomenon known as time decay or theta. This makes it crucial for traders to plan their trades around expiration date.

Types of Expiration: Options with weekly expirations are ideal for short-term strategies, while monthly expirations are better suites for medium-to long-term strategies.

Action or Expiry: On the expiration date, in-the-money (ITM) options are exercised or settled, while out-of-the-money (OTM) options expire worthless. Traders must close their positions or risk automatic settlement if ITM.

In-the-Money or ITM

The call option is In-the-Money if the current market price of an underlying asset is more than its strike price. Conversely, the put option is In-the-Money if its current market price is less than its strike price

At-The-Money or ATM

It indicates a situation wherein the strike price of a call or put option is equivalent to the prevailing market price of an underlying asset.

Over-The-Money or OTM

When the strike price is more than the current market price of an underlying asset, the call option is said to be OTM. Similarly, when the strike price is lower than the current market price of an underlying asset, the put options is said to be at OTM

Significance of NSE Option Chain

Here are some benefits of referring to Nifty Option Chain

- Offers a glance at the In-the-Money (ITM) and Out-the-Money (OTM) options.

- It proves useful for assessing the depth and liquidity of specific strikes.

- It aids traders to find option premium against its corresponding maturity date and strike price.

- Option Chain serves as a warning against breakouts or sharp moves in the index.

- Unlike, stock option chain, the Index option chain provides macro-level indications. Regardless, the former serves as a potent stock-level indicator.

- It provides a better view of the economic straddles and strangulations at various strike prices. Thus, enabling them to align investments as per market sentiments.

How to Read a Live Option Chain

Reading a live option chain may seem overwhelming at first, but with a systematic approach, you can extract meaningful insights quickly. Here’s how:

Select the Underlying asset:

Choose the stock or index for which you want to view the option chain. Ensure that you understand its price movements and key drives

Choose the Expirations Date:

Decide whether you want to trade options with short-term or Long-term expirations dates. Near-term options are better for quick trades, while longer-term options can suit strategic investments

Analyze strike prices:

Strike prices are arranged in the center of the option chain. Identify the At-the-money(ATM) option (strike prices closest to the current market price) and the In-the-Money (ITM) or Out-of-the-Money (OTM) options for your strategy. ATM options are generally more liquid and have balanced risk and reward.

Focus on Bid-Ask Spread:

Check the difference between the bid(buy) and ask(sell) prices. A narrow spread indicates high liquidity, which is advantageous for traders as it reduces translation costs.

Evaluate Open Interest (OI):

High OI shows where market participants are most active. For example, a high OI at a particular strike price indicates significant interest and potential resistance or support levels

Monitor Trading Volume:

Observe the daily volume for each strike price.

High volumes suggest active trading, making these options easier to buy or sell. Combine volume data with OI to confirm market trends

Assess Premiums and IV:

Review the premiums and implied volatility (IV).

High premiums often coincide with high IV, reflecting increased market uncertainty. Compare IV across options to detect undervalued or overvalued opportunities.

Compare Call and Put Activity:

Identify whether call options (bullish sentiment) or put options (bearish sentiment) are dominant trading activity.

This comparison helps gauge market sentiment and potential price directions.

Look for Patterns:

Advanced traders often use live option chains to identify patterns like unusual OI spikes, significant changes in premiums, or imbalance call/put rations. These can signal upcoming price moves or significant events.

Set Alerts and Track Changes:

Use your trading platform to set alerts for key metrics like OI or IV changes. Regularly monitor how these metrics evolve to fine-tune your strategy.

Where to Access Live Option Chains

Accessing live option chains is critical for making informed trading decisions. Here are the primary sources:

Broker platforms: Most brokers, such as Zerodha, Interactive Brokers, and offer built-in tools for viewing live options chains. These platforms provide comprehensive data , including real-time premiums, OI, and IV, making them ideal for traders of all levels.

Stock Exchange Websites: Major stock exchanges like the NSE(National Stock Exchange) and BSE(Bombay Stock Exchange) offer free access to live option chain data on their official websites. These platforms are reliable and accurate but may lack advanced customization options.

Finance News Websites: Portals like Yahoo Finance, Bloomberg, and Marketwatch provide live option chain data alongside market news. These are great for traders who want to combine news analysis with technical data.

Data vendors: Several data vendors specialize in providing live option chain data for traders. These vendors typically offer subscription plans with access to real-time data, historical data, and advanced analytics.

Examples include ValveNet Technologies, GlobalDatafeeds, etc and similar providers. They are ideal for traders who require uninterrupted and highly reliable data feds for analysis and trading.

CONCLUSION:

Learning to navigate the option chain live is a crucial skill for any options trader. It provides a comprehensive view of the market, empowering you to make smarter and more confident trading decisions. As a beginner, focus on understanding the basics, practice consistently, and gradually build your expertise. Remember, success in options trading comes with patience, practice, and discipline.