Imagine you’re on a rollercoaster—you’re climbing up slowly (markets are rising), and then suddenly, WHOOSH! You’re speeding down (markets dip). Intraday trading feels just like that. It’s thrilling, fast-paced, and sometimes a little scary.

But here’s the twist: unlike a rollercoaster, you’re in control of the ride. With the right strategies, tools, and Real-time data, you can turn those ups and downs into profitable opportunities. Ready to master the ride? Let’s begin!

What is intraday trading?

Intraday trading is when you buy and sell stocks on the same day, within market hours. The goal is simple: make a profit from small price movements during the day. Unlike long-term investments where you wait for months or years, intraday trading focuses on quick decisions and fast results.

This type of trading is exciting but also challenging. It requires a good understanding of the market, clear strategies, and, most importantly, access to real-time data. Why? Because stock prices can change in seconds, and having the latest updates can help you grab profitable opportunities or avoid losses.

Intraday trading is great for those who want to avoid the overnight risks that come with holding stocks after market hours. But it’s not just about luck. To succeed, you need the right tools, smart strategies, and a disciplined approach.

In this blog, we’ll make things easy for you. Whether you’re new to trading or have some experience, we’ll explain the best strategies, tips, and tools that can help you trade better. And we’ll show why real-time data is the secret weapon for every intraday trader.

Key Strategies for Successful Intraday Trading:

Trend Following or Trend trading

Trend following is a systematic investment strategy that aims to profit from market trends by buying assets when their prices are rising and selling when they fall. The strategy is based on the expectation that price trends will continue.

How it works:

Uptrend: The price consistently makes higher highs and higher lows. Traders buy during pullbacks or near support levels.

Downtrend: The price makes lower highs and lower lows. Traders sell short during minor upward retracements.

Breakout Trading

Breakout trading is a strategy that involves buying or selling financial securities when they break through a support or resistance level or form a breakout pattern. Watch for stocks breaking through key support or resistance levels. Use volume indicators to confirm breakout strength.

How it works:

A breakout happens when a stock price moves beyond a critical level (support/resistance) with increased volume.

Traders enter a position in the breakout’s direction, aiming to ride the momentum.

Momentum Trading

Trade stocks with high volatility and volume. Momentum trading is a strategy that involves buying and selling assets based on their current price trends. Combine indicators like RSI and MACD for better entry and exit signals.

How it works:

Traders look for stocks moving sharply in one direction due to news or earnings.

They enter the trade and ride the momentum until signs of exhaustion appear.

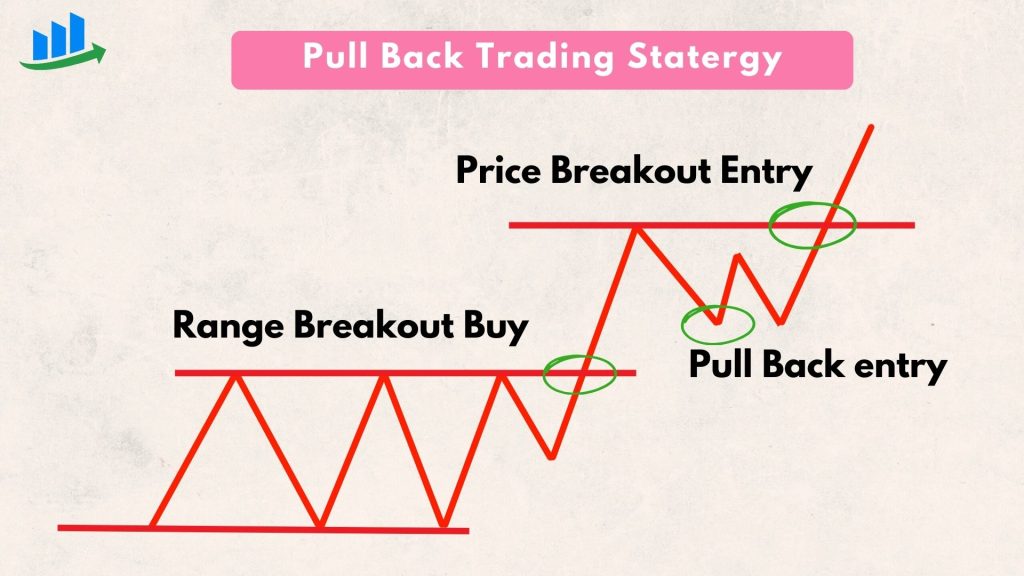

Pullback Trading

Look for temporary dips (pullbacks) in an uptrend or short-lived spikes in a downtrend. Enter trades when the trend resumes, using tools like Fibonacci retracements or moving averages to identify pullback levels.

How it works:

In an uptrend, traders buy when the price dips near a support level.

In a downtrend, traders sell short when the price rises temporarily to a resistance level

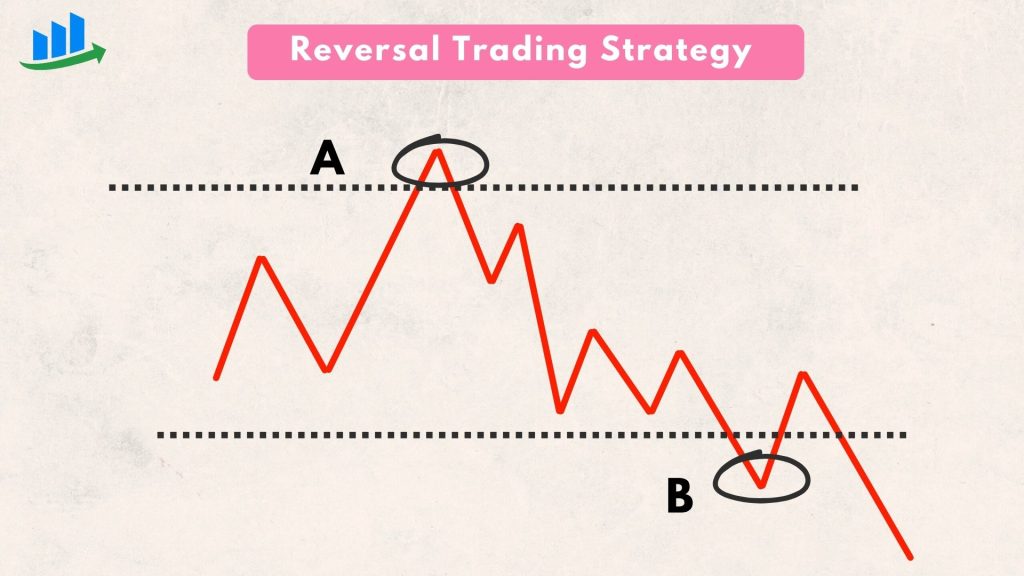

Reversal Trading

Spot potential trend reversals using candlestick patterns like Doji, Hammer, or Engulfing patterns. Combine these with indicators like RSI to confirm overbought or oversold conditions.

How it works:

Traders use candlestick patterns and overbought/oversold indicators to predict reversals.

This strategy works best at key support or resistance levels

Gap Trading

Focus on stocks that open significantly higher or lower than their previous close due to overnight news. Use gap-up or gap-down patterns to predict the next market move.

How it works:

Breakaway gaps- Occur at the start of a new trend, often with high volume.

Continuation Gaps: Appear during a strong trend, signaling further movement.

Exhaustion Gaps: Form near the end of a trend, often reversing direction soon after.

Traders analyse whether the gap is likely to close (mean reversion) or continue in the direction of the opening price.

Volume-Based Trading

High trading volumes often indicate strong interest in a stock. Use tools like volume oscillators to confirm the strength of a price movement before entering a trade.

How it works:

Stocks with unusually high volumes often indicate strong interest and reliable price actions.

Volume spikes typically precede large price movements, helping traders confirm breakout or reversal signals.

High-Low Breakout

Focus on stocks breaking their intraday high or low. These breakout points often signal strong momentum in the direction of the breakout.

How it works:

Breakouts above highs: suggest strong upward momentum, a bullish signal for entering buy trades.

Breakouts below lows: Indicate bearish momentum, signalling opportunities to sell or short.

Traders wait for a breakout confirmation, usually with high volume, to avoid false signals.

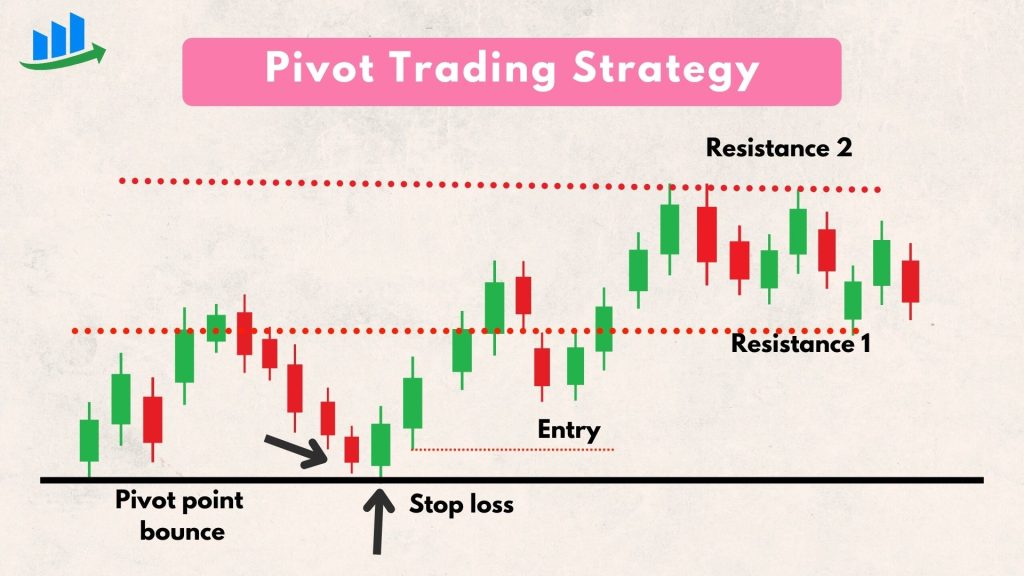

Pivot Point Trading

Use daily pivot points to identify key support and resistance levels. Plan trades based on price action around these levels. This strategy is useful in the forex market. The range-bound traders can use it as an entry strategy, while the breakout traders can understand breakout levels.

How it works:

Pivot points divide the market into key levels:

The pivot point (PP): the central level where the price tends to hover.

Support levels (S1, S2, S3): Price levels above the pivot point

Resistance levels: (R1, R2, R3): Price levels above the pivot point

Traders buy near support levels and sell near resistance levels or trade breakouts from these levels.

Each strategy works best in specific market conditions. The key is to test, adapt, and combine strategies to find what works for your trading style. Always rely on real-time data to make precise and informed decisions!

Intraday Tips for Beginners

Start with a Demo Account

- Practice on a demo trading platform before using real money. This helps you understand marketbehaviourr without risking capital. Creating an account in Zerodha is a simple and hassle-free process that anyone can complete in just a few steps

- Focus on One or Two Stocks

Avoid spreading your attention too thin. Start by trading one or two stocks to understand their price movement and behaviour.

- Set Clear Goals

Decide how much you’re willing to gain or lose in a day. Stick to these limits to avoid emotional decision-making.

- Learn to Use REAL-TIME DATA

Accessing and interpreting real-time data is crucial for making timely and informed trades. Practice reading charts and indicators in real-time.

- Stick to a Strategy

Choose one simple strategy, like trend following or breakout trading, and master it before trying advanced techniques.

- Avoid Trading at Market Open

The first 15-20 minutes can be highly volatile. Observe the market during this time and plan your trades based on the trend.

- Keep Emotions in Check

Fear and greed are a trader’s worst enemies. Stick to your plan and avoid impulsive decisions. - Use Stop-Loss Orders

Always set a stop-loss to limit your losses. This protects your capital if the market moves against you.

Essential Tools for Intraday Trading

1. Real-Time Data Feeds

Accurate and timely Real-time data is the backbone of intraday trading; it generates with a short delay. Its continuous flow of information about prices, volumes, trading activities, and other metrics for sites like stocks, bonds, commodities, and indices. Here I shared above the chart of Nifty real-time data for Amibroker.

Real-time data is available from some brokerages and paid services.

2. Trading Platforms

A robust trading platform is essential for executing your strategies smoothly. Platforms like Zerodho Kite, and TradingView. And Amibroker offers advanced charting features, real-time price alerts, and seamless ordering. r. Look for platforms with features customizable charts, technical indicators, and an intuitive interface to make trading more efficient.

3. Risk management Tools

Managing risk is key to long-term success in intraday trading. Tools like stop-loss and take-profit orders automatically execute traders when a stock reaches a specific price, protecting you from excessive losses or locking in profits.

4. News Feeds and Alerts

In Intraday trading, staying updated on market-moving news is essential. News feeds from reliable sources help you react quickly to major events such as earnings reports, government policies, or global economic news. Set up alerts for breaking news to ensure you don’t miss out on opportunities.

CONCLUSION:

To succeed as a day trader, selecting the right stocks for intraday trading is crucial. Many traders struggle to make profits because they fail to choose stocks that are suitable for short-trading. IF not approached with care, day trading can have a significant impact on your financial health. However, by applying the strategies and tips discussed above, traders can minimise risks and increase their chances of earning consistent returns.

Proper stock selections, combined with effective risk management, are key to making successful trades and achieving profitability in intraday trading.